CIT Bank SWIFT Code: Navigating the world of international finance often requires understanding SWIFT codes, those unique identifiers crucial for seamless cross-border transactions. This guide delves into the specifics of CIT Bank’s SWIFT code, explaining its purpose, how to find it, and the security measures surrounding its use. We’ll explore the process of international transfers, potential challenges, and compare CIT Bank’s practices with those of other major financial institutions.

Understanding the CIT Bank SWIFT code is crucial for international transactions. However, before initiating any such transfers, it’s important to consider the bank’s physical presence; you might wonder, “does CIT Bank have branches?” Checking this out first, by visiting does cit bank have branches , can help you determine the most efficient method for managing your funds and using the CIT Bank SWIFT code correctly.

Knowing their branch structure directly impacts how you interact with their SWIFT code services.

Understanding these intricacies empowers both individuals and businesses to confidently manage their global financial activities.

From the fundamental structure of a SWIFT code to the practical steps involved in verifying its authenticity, we aim to provide a clear and concise understanding. We’ll also cover essential security protocols to protect your sensitive financial information and mitigate risks associated with international transfers. This comprehensive guide serves as your complete resource for all things related to CIT Bank’s SWIFT code and international banking.

Understanding SWIFT Codes and Their Purpose: Cit Bank Swift Code

Euy, ngobrolin SWIFT Codes, teu weleh penting pisan lah, khususna lamun urang sering ngalakukeun transaksi internasional. Singkatna, SWIFT Code ieu kayak KTP-na bank di dunia internasional. Jadi, mudah pisan dipake pikeun ngarahkeun duit ka tempat nu dituju.

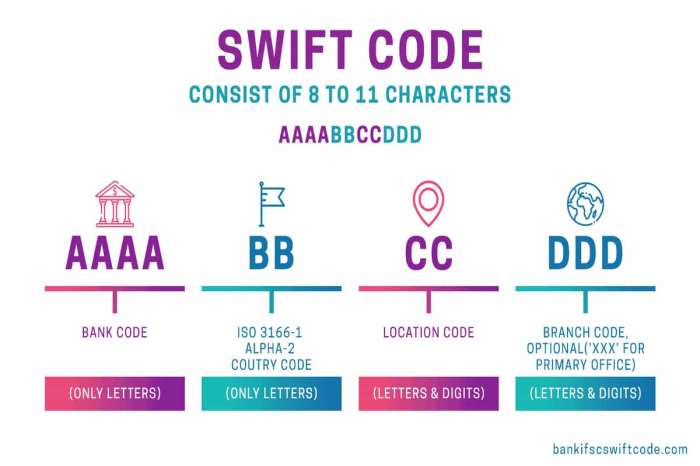

SWIFT Codes (Society for Worldwide Interbank Financial Telecommunication) ieu kode unik anu dipaké ku bank-bank di sakuliah dunya pikeun ngolah transaksi internasional. Kode ieu ngamungkinkeun transfer dana internasional sacara efisien sareng aman. Strukturna biasana 8 atawa 11 karakter, ngandung informasi ngeunaan bank, lokasi, sareng nagara.

SWIFT Code Structure and Components

Struktur SWIFT Code ieu biasana 8 atawa 11 karakter. 4 karakter mimiti nunjukkeun kode bank, 2 karakter salajengna nunjukkeun kode nagara, 2 karakter salajengna nunjukkeun kode lokasi, sareng 2 atawa 3 karakter terakhir nunjukkeun kode cabang (optional). Contohna, SWIFT Code `SWIFTXXXX` mun 8 karakter.

Examples of SWIFT Code Usage in Wire Transfers

Bayangkeun urang kirim duit ka luar negeri. SWIFT Code ieu penting pisan, sabab ngarahkeun dana ka rekening anu leres. Lamun teu bener SWIFT Codena, duit urang bisa salah alamat, ah.

| Bank Name | SWIFT Code | Location | Country |

|---|---|---|---|

| Example Bank 1 | EXAMPLEABXX | Bandung | Indonesia |

| Example Bank 2 | EXAMPLEUSNY | New York | USA |

| Example Bank 3 | EXAMPLEUKLO | London | UK |

| Example Bank 4 | EXAMPLESGSP | Singapore | Singapore |

Finding the CIT Bank SWIFT Code

Nemuan SWIFT Code CIT Bank teu susah pisan. Biasana aya di website resmi CIT Bank, atawa bisa ogé ditanya langsung ka pihak bank.

Locating the SWIFT Code on the CIT Bank Website

Cara nu paling gampang nyaeta ku cara ngajajah website resmi CIT Bank. Biasana informasi SWIFT Code bakal aya di bagian “Contact Us”, “International Banking”, atawa bagian nu sarupa.

Alternative Methods for Finding the CIT Bank SWIFT Code

Mun teu kapanggih di website, urang bisa nelepon call center CIT Bank, atawa datang langsung ka cabang CIT Bank terdekat.

Verifying the Authenticity of a SWIFT Code

Source: investopedia.com

- Pastikeun sumber informasi ti website resmi CIT Bank.

- Cocogkeun SWIFT Code nu kapanggih jeung informasi nu aya di dokumen resmi CIT Bank (lamun aya).

- Konfirmasi ka pihak CIT Bank langsung.

CIT Bank’s International Transaction Services

CIT Bank nawarkeun rupa-rupa jasa transaksi internasional, kaasup transfer wire, bayaran internasional lianna.

Types of International Transactions Facilitated by CIT Bank, Cit bank swift code

Source: theinformant247.com

CIT Bank ngolah rupa-rupa transaksi internasional, kaasup transfer dana ka luar negeri, pembayaran internasional pikeun barang jeung jasa.

Fees Associated with International Wire Transfers

Biaya transfer internasional gumantung kana sababaraha faktor, kaasup jumlah dana, nagara tujuan, sareng jenis akun.

Potential Delays or Issues During International Transfers

- Masalah Teknis: Gangguan sistem bank bisa nyababkeun keterlambatan.

- Informasi Nu Kurang Lengkap: Pastikeun sagala informasi bener sareng lengkap.

- Aturan Regulasi: Aturan di nagara tujuan bisa ngalambatkeun transaksi.

Solutions for Potential Problems

- Masalah Teknis: Hubungi pihak CIT Bank.

- Informasi Nu Kurang Lengkap: Pastikeun sagala informasi bener sareng lengkap.

- Aturan Regulasi: Pastikeun urang ngarti aturan jeung regulasi di nagara tujuan.

Security Considerations When Using SWIFT Codes

Keamanan informasi SWIFT Code penting pisan. Jangan sampe kode ieu kapake ku pihak nu teu bertanggung jawab.

Security Measures Implemented by CIT Bank

CIT Bank ngalaksanakeun rupa-rupa ukuran keamanan pikeun ngajaga transaksi SWIFT Code, kaasup enkripsi data sareng sistem verifikasi.

Risks Associated with Improper Sharing of SWIFT Codes

Ngabagi SWIFT Code ka pihak nu teu bertanggung jawab bisa ngakibatkeun pencurian dana, atawa hal-hal nu teu dipiharep.

Best Practices for Securing and Protecting SWIFT Code Information

- Simpen SWIFT Code di tempat anu aman.

- Jangan ngabagi SWIFT Code ka pihak nu teu bertanggung jawab.

- Gunakan password anu kuat pikeun ngajaga akun banking.

Security Recommendations for Individuals and Businesses

Source: tribesingapore.com

- Pastikeun sumber SWIFT Code ti sumber nu dipercaya.

- Gunakan metode komunikasi anu aman pikeun ngirimkeun SWIFT Code.

- Laporkeun langsung ka CIT Bank mun aya hal nu teu bere.

Comparison with Other Banks’ SWIFT Codes

Prosés ngadamel SWIFT Code di CIT Bank hampir sarua jeung bank-bank lianna. Bedana mungkin aya dina sistem atawa platform nu dipaké.

Differences in SWIFT Code Format or Structure

Format SWIFT Code ieu standar, tapi bisa jadi aya bedana dina sistem atawa platform anu dipaké ku bank-bank anu béda.

Implications of Differences for International Transactions

Bedana ieu bisa ngaruh kana kecepatan sareng keamanan transaksi internasional.

Impact of SWIFT Code Handling Variations on Transaction Speed and Security

Sistem anu leuwih canggih bisa ngajamin kecepatan sareng keamanan transaksi.

Illustrative Example of a CIT Bank SWIFT Code Transaction

Hayu urang bayangkeun urang ngirim duit ka luar negeri ngagunakeun CIT Bank.

Steps Involved in an International Wire Transfer

-

Kumpulkeun sagala informasi anu diperlukeun, kaasup SWIFT Code CIT Bank, rekening tujuan, jumlah dana, sarta informasi lianna.

-

Ngakses layanan transfer internasional di CIT Bank, bisa online atawa langsung ka cabang.

-

Isina formulir transfer internasional jeung pastikeun sagala informasi bener.

-

Konfirmasi transaksi sareng mayar biaya anu diperlukeun.

-

Pantau status transaksi nepi ka rampung.

Epilogue

Successfully navigating international banking hinges on a thorough understanding of SWIFT codes, and CIT Bank’s system is no exception. This guide has provided a comprehensive overview of finding, verifying, and securely using CIT Bank’s SWIFT code for international transactions. By understanding the intricacies of SWIFT codes, potential challenges, and the security measures in place, individuals and businesses can confidently execute international transfers with CIT Bank, minimizing risks and ensuring smooth, efficient financial processes.

Remember to always prioritize security and verify information from official sources.